Table of Content

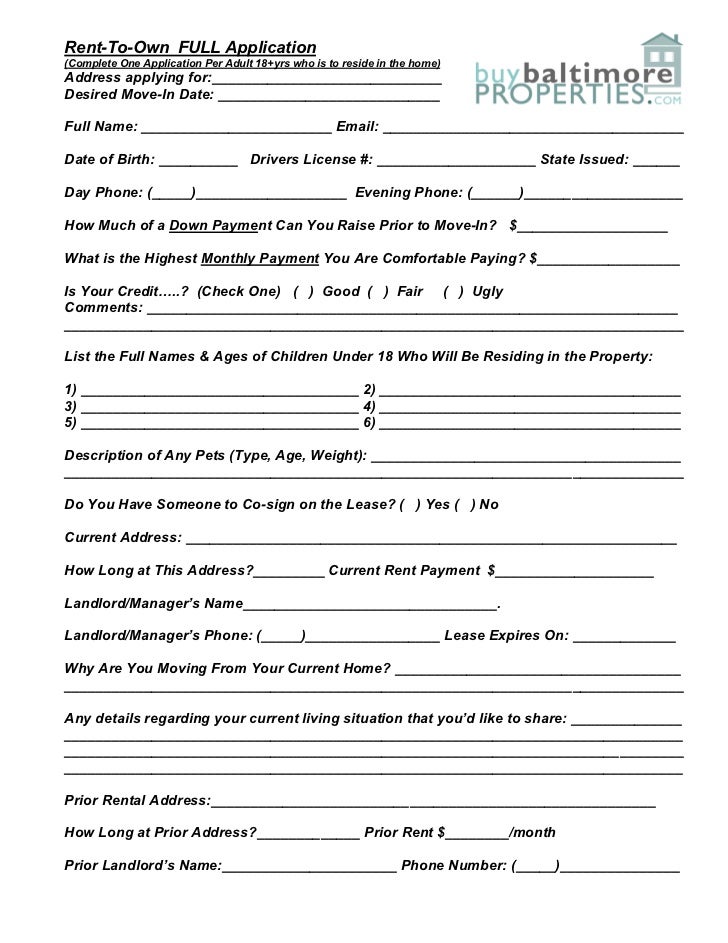

"No Credit Needed" does not mean or imply that no inquiry will be made of credit history or creditworthiness. Becca's Home may check credit history and creditworthiness, but no established credit history is necessary. Lots of people opt for rent to own financing due to its many benefits and advantages.

Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Please adjust the settings in your browser to make sure JavaScript is turned on. Renting your very own apartment can be a liberating experience. Perhaps it signifies newfound independence or an exciting,...

Negotiate a purchase price.

A rent-to-own home—sometimes called a lease-to-own home—is a house you rent for a limited time, then buy when your lease ends. There are multiple problems with a predatory rent-to-own arrangement like the ones mentioned above. But we know many rent-to-own agreements can be beneficial and legitimate. The phrase “rent-to-own” has a long and complicated history. Unfortunately, in some cases, it was used to defraud people and lure them into predatory housing situations.

They can’t avail of any favorable movements in home loans or property prices. Rent-to-own opportunities aren’t that readily available, but they are out there. The tenant can opt for the traditional route of legwork or use some online services.

About Chase

Ultimately, the renter will decide if the transaction happens. However, while rent-to-own or lease-to-own financing doesn’t negatively affect your credit score, it can positively affect it. If you make regular payments on time, and in their full amounts, most financers will report that information to the big credit bureaus . In this way, rent to own furniture financing works with you instead of against you no matter where you work or how you get paid. Many rent to own furniture financers include auto-pay controls or settings, too.

Rent-to-own homes are homes that include a clause in the rental agreement which either gives you the option to buy or an obligation to buy after a certain time period. You make rent payments each month and a portion of those payments can count toward your down payment. Should you decide to buy, the excess money can be applied to the home purchase. Find expert agents to help you buy your home.To live in a rent-to-own home, you’ll sign a contract agreeing to the length of the lease, home price and other factors. (I’ll get to all that in a bit.) The lease contract also spells out if the landlord has to put a certain amount of your rent payments toward the purchase price of the home.

Recommended Articles

So, a person could pay $1,000 per month in rent, plus $250 per month for the eventual down payment. It's also standard for the renter to put down 3 to 5 percent of the home's value as a nonrefundable deposit before taking residence. Prequalifying can save every homebuyer a lot of time and show a seller you're in a financial position to purchase a home. As a renter, you can spend time saving money or working to build your credit before purchasing a home.

It should also explain whether or not a percentage of the payment goes toward the purchase price of the home. If this is the case, you should expect the monthly rent payment to be slightly higher than average. Another way rent-to-home can give you a bit more leeway as a buyer? Negotiating the terms of the contract and the purchase price of the home. In the traditional home-buying process, the owners set the cost, and you bid against other buyers in a blind-bidding process to see who offers the most money. Even if you pitch a sizable down payment, you may not get the home.

The Benefits of Rent To Own Furniture, Appliances, and More

It’s a quick and convenient way to acquire profitable sums of money from people in financially vulnerable situations. When you see a new t-shirt that you love, you typically try it on first. When you’re shopping for a car, you usually take it for a quick test drive. With a rent to own, you apply that same philosophy to your house. You may face some severe hardships if you want to qualify for a traditional home loan.

This mode provides different assistive options to help users with cognitive impairments such as Dyslexia, Autism, CVA, and others, to focus on the essential elements of the website more easily. Discover the benefits and drawbacks of no credit needed purchases now. However, they discover that the couch isn’t a good fit for their home.

If a home buyer sees that a home has been on the market for a long time, they may approach the seller with a rent to own offer. If your credit is perfect, you’ll want to avoid a company with this option, or maybe stick to working with an individual landlord/seller. Institutional rent-to-own companies are often publicly traded, so they’re subject to a whole host of regulatory scrutiny, which means they’ll be more stringent about consumer protection. This means your contracts will be very clear about the rules of engagement, who holds the down payment funds, and how disputes are resolved. You can lock in the future sale price of your home now, and not have to worry about market fluctuations. These schemes often make the renters bind to the agreement’s conditions, which can sometimes become burdensome.

If there's anything you're unsure of with a rent-to-own agreement, it's better to ask questions sooner rather than. For instance, it's a good idea to know under which conditions could you lose your option to buy the property. Under some contracts, you lose this right if you are late on just one rent payment or if you fail to notify the seller in writing of your intent to buy.

For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback. Check out the Price Trends info on every Trulia listing to see the average price of new and resale home based on current data. If a tenant is happy in their rental home, but the landlord wants to sell it, the tenant may ask to have a rent to own arrangement. It allows the tenants to assess the living experience during the trial period before buying the properties. A lessor is a person or other entity that owns an asset but which is leased under an agreement to the lessee. It's essential to perform certain due diligence before buying any home, including rent-to-own properties.

You’ll likely forfeit any money paid up to that point, including the option money and any rent credit earned, but you won’t be under any obligation to continue renting or to buy the home. What happens when the contract ends depends partly on which type of agreement you signed. If you have a lease-option contract and want to buy the property, you’ll probably need to obtain a mortgage in order to pay the seller in full.

Rent Goes to the House Payment

You may want to negotiate some points before signing or avoid the deal if it's not favorable enough to you. It's important to read the fine print on a rent-to-own agreement to understand whether it's lease-option or lease-purchase. Entering into a rent-to-own agreement typically means signing a formal legal contract.

No comments:

Post a Comment